Describes the principles of taxation and its impact on economic entities and public finances. The course addresses tax rules, types of taxes, and their administration. It helps students understand the role of taxes in state financing and their influence on business and individual decision-making.

Available in the following languages:

30 Various Services Customized to Your Needs

We have been listening to you and supporting your growth for 4 years.

Why Educate Yourself in Finance?

Understanding finance is today one of the most important skills, affecting both personal and professional life. It enables better budget planning, helps avoid unnecessary debt, and allows for informed decisions about investments or savings. Financial education provides confidence in managing one’s own resources and navigating the economic environment.

Knowledge of the principles of the financial world opens new career opportunities and helps understand how banks, taxes, and investment markets operate. Education in finance also develops logical thinking, analytical skills, and strategic decision-making. Financial literacy is therefore not just about money, but about the ability to responsibly manage your own future.

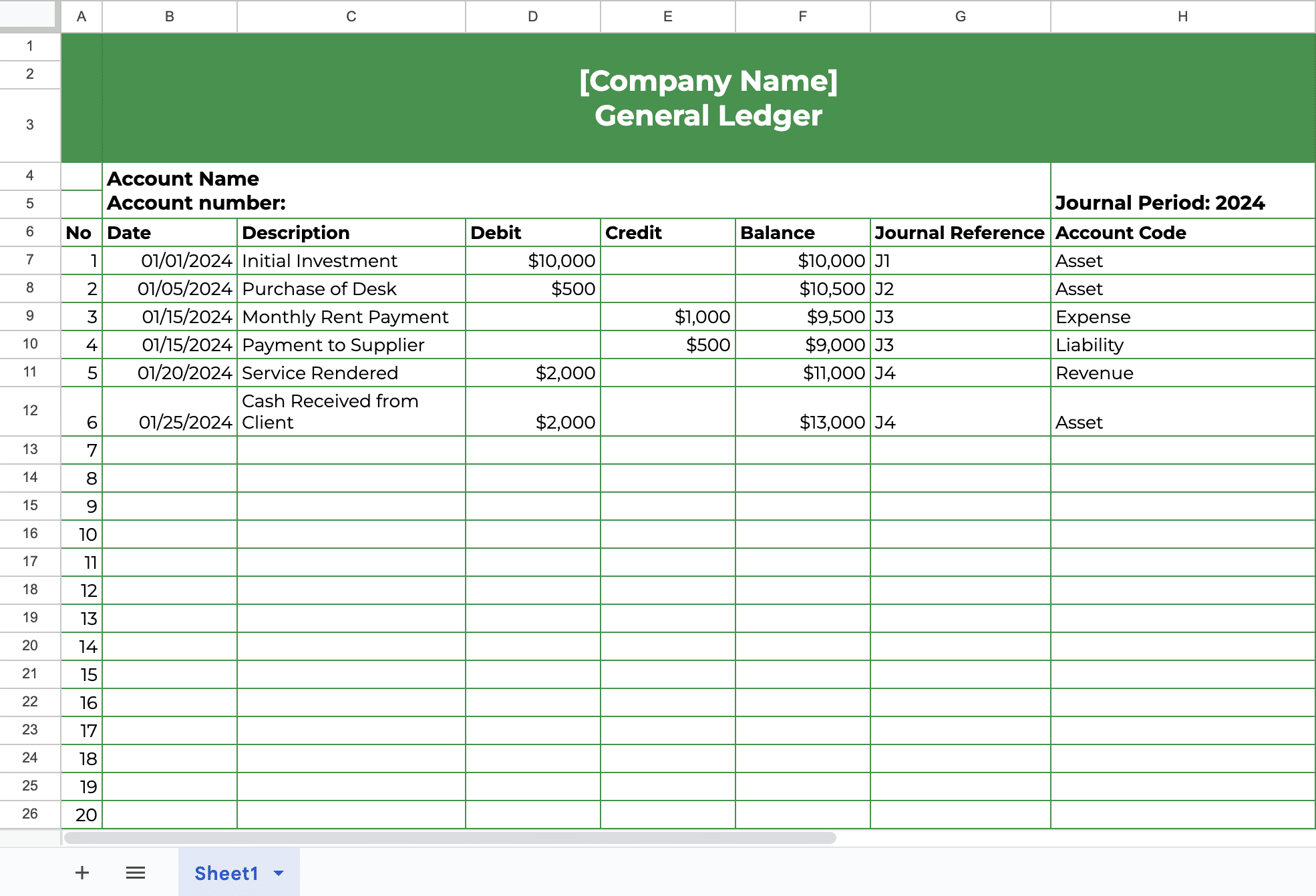

Basic Principles of Accounting

Accounting is a system for recording, classifying, and interpreting financial information that allows an organization’s operations to be monitored. Its purpose is to provide an accurate and understandable picture of assets, liabilities, and business performance. Proper accounting helps companies make informed decisions, meet legal obligations, and maintain financial stability.

The foundation of accounting lies in principles such as faithful representation, the accrual principle, and the prudence principle. These rules ensure that financial statements accurately reflect reality and that economic transactions are recorded in the period in which they occur. Accounting is therefore not only a tool for record-keeping but also a key element of transparency and trust in the financial world.

Basic Areas

Banking Sector

Focuses on understanding how banks operate, their role in the economy, and their relationship with the central bank. Students learn about the process of granting loans, risk management, and banking regulation. The course develops an understanding of financial stability and the functioning of monetary policy.

Financial Markets

Examines the structure and functioning of financial markets, including capital, money, and foreign exchange markets. The instruction focuses on trading instruments, investment strategies, and market regulation. The goal is to understand the impact of financial flows on the economy and investor decision-making.

Basics of Accounting

Covers the principles of maintaining accounting records and documenting a company’s financial transactions. Students learn to prepare financial statements, analyze business results, and understand the logic of accounting rules. Emphasis is placed on accuracy, clarity, and transparency of financial information.

The Eurostat analysis explored employment in the finance and insurance sector across the EU. It showed how this field contributes to the broader economy and how its share varies among member states. The findings highlight differences in economic structures and labour markets.

- Focus on sector diversity

- Variation across EU countries

- Insights into economic structure

- Understanding workforce distribution

Whatever your opinion about finance, knowledge in this area can be applied in both professional and personal life. It helps to better plan budgets, analyze income and expenses, make investment decisions, and handle unexpected financial situations. Understanding the basic principles of accounting and the functioning of financial markets enables informed decision-making and reduces the risk of mistakes. Financial literacy also boosts confidence, promotes a responsible approach to money, and improves navigation in the economic environment.